days sales in inventory ratio interpretation

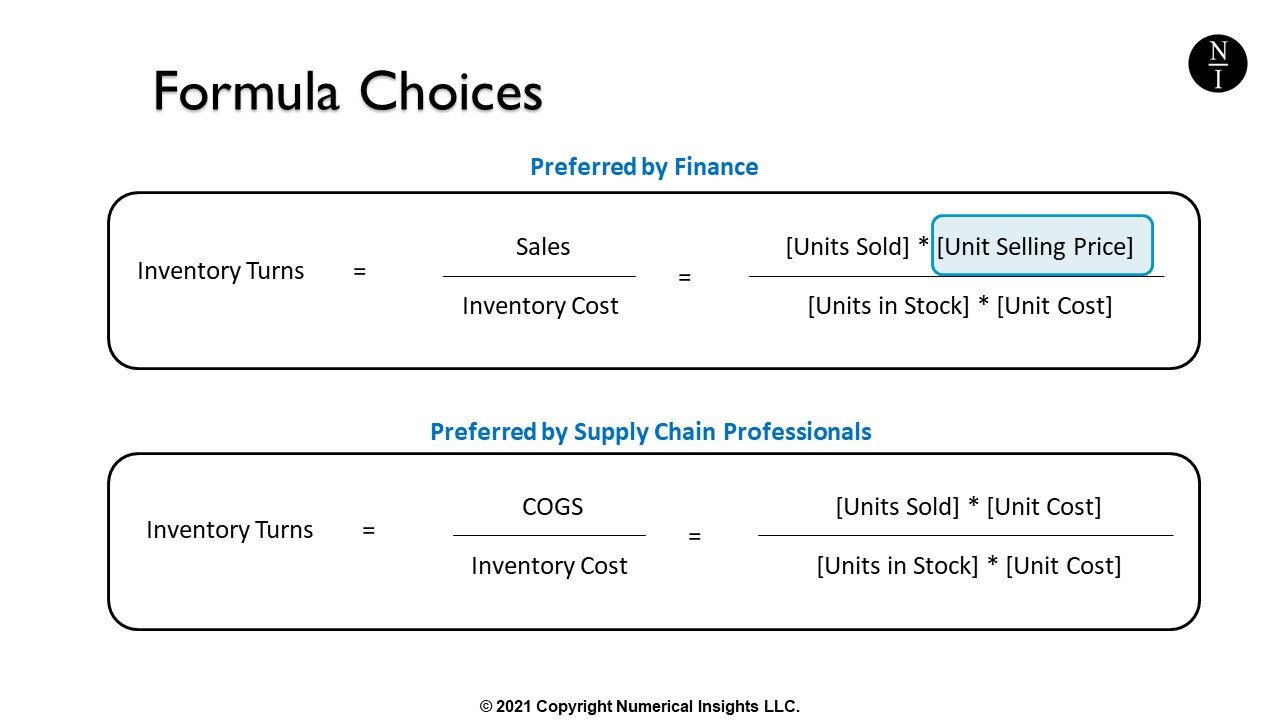

Days Inventory Outstanding Average inventory Cost of sales x Number of days in period. A high inventory turnover ratio implies either strong sales or ineffective buying the company buys too often in small quantities therefore the buying price is higherA high inventory turnover ratio can indicate better liquidity but it can also indicate a shortage or inadequate inventory levels which may lead to a loss in business.

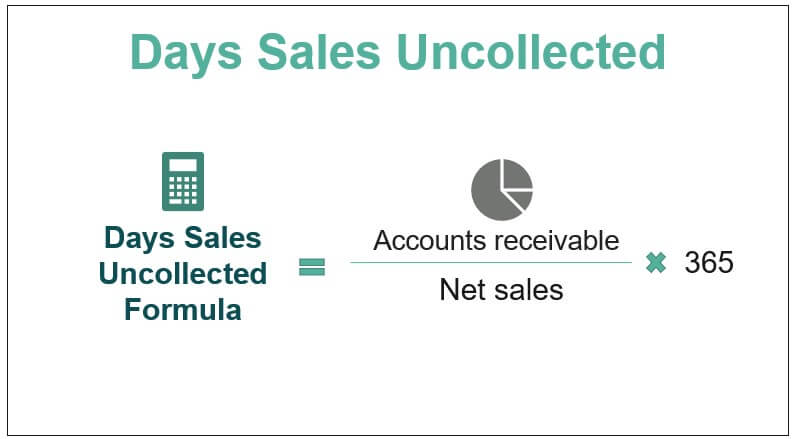

Day S Sales Uncollected Formula Step By Step Calculation Examples

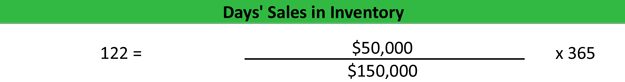

The number of days in a year 365 or 360 days divided by the inventory turnover ratio.

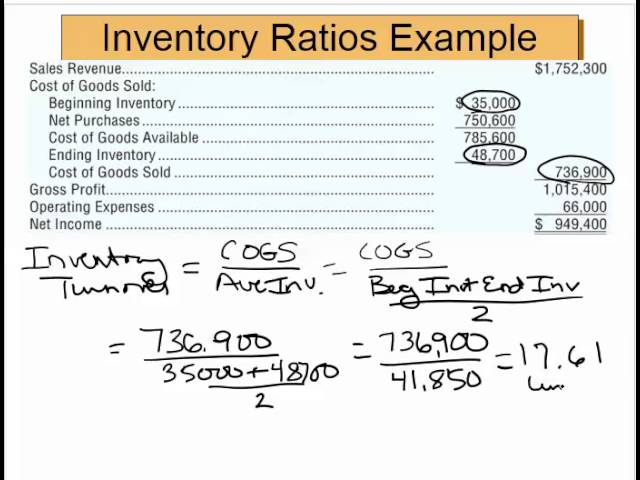

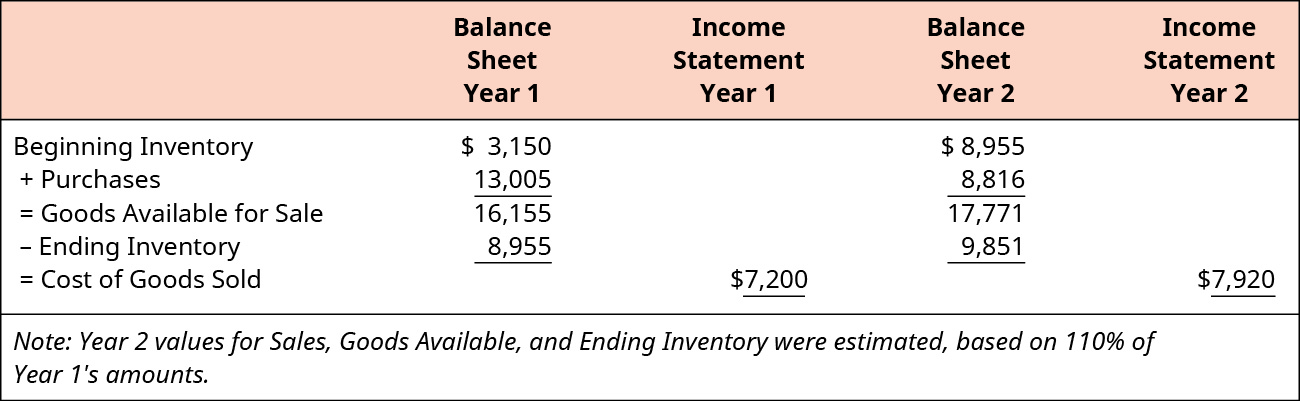

. Example of Days Sales in Inventory. Both inventory turnover and inventory. Inventory Turnover Days Year 1 314 310 2 3351 360 335.

Accounts receivable can be found on the year-end balance sheet. The following is the formula for calculating days sales in inventory. Cost of Goods Sold.

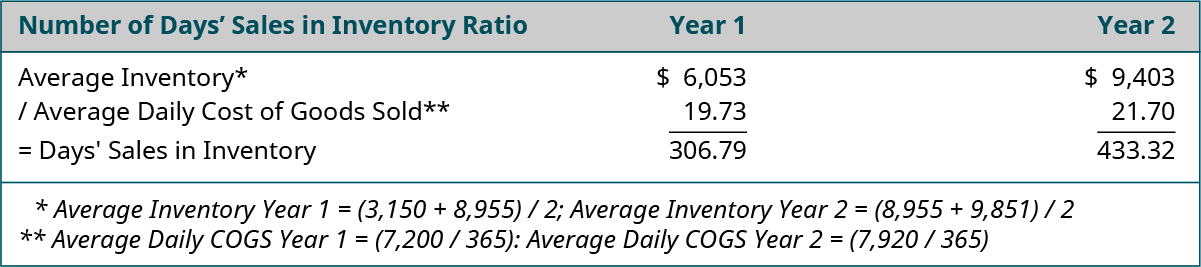

Days sales in inventory ratio interpretation Wednesday March 9 2022 Edit It is the number of days or months in which the inventory is converted into sales to determine the cash conversion cycle Determine The Cash Conversion Cycle The Cash Conversion Cycle CCC is a ratio analysis measure to evaluate the number of days or time a company converts its inventory and. For example if a company has average inventory of 1 million and an annual cost of goods sold of 6 million its days sales in inventory is calculated as. Number of days sales in receivables days 6.

Inventory days also known as days inventory outstanding DIO is a financial ratio showing the average holding period of inventory before it is used or sold. Return on total assets 13. Inventory turnover days 360 4 90 days.

High or rising inventory to sales ratio indicates that the company is incurring more storage and holding cost. Inventory days ratio. To put it differently the times sales in inventory ratio reveals the number of days per firms recent asset of stock will continue.

The days sales in accounts receivable can be calculated as follows. Benchmark can be entitys own last years performance industry average competitors turnover period etc. Times interest earned 11.

Ratio of fixed assets to long-term liabilities 9. Days Sales in Inventory DSI sometimes known as inventory days or days in inventory is a measurement of the average number of days or time required for a business to convert its inventory Inventory Inventory is a current asset account found on the balance sheet consisting of all raw materials work-in-progress and finished goods that a into sales. Return on stockholders equity 14.

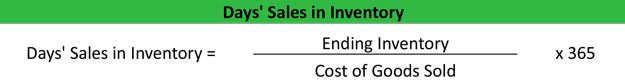

This indicates that Company As funds were blocked in inventories for almost 89 days. The days sales of inventory DSI is a financial ratio that indicates the average time in days that a company takes to turn its inventory including goods that are a work in progress into sales. Days sales in inventory can also be called days inventory outstanding or the average age of an inventory.

1 million inventory 6 million cost of goods sold x 365 days. In year 1 company averagely needed 335 days to turn its inventory into sales. All inventories are a summation of finished goods work in progress and progress payments.

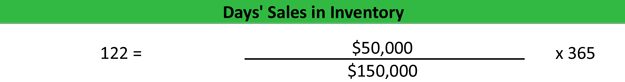

Using 360 as the number of days in the year the companys days sales in inventory. Company A 123500 365 8979 days. Day of Sales in Inventory 183 2506666 1446000 105 days.

What this means is that Company A takes around 89 days to sell all of its Inventory during a year. Inventory days Inventory Cost of goods sold 365 Inventory days 20000 176000 365 41 days The business on average is holding 41 days of sales in its inventory. Inventory Turnover Days Year 2 316 314 2 3854 360 294.

Inventory to sales ratio measures the rate at which the company is liquidating its stocks. This formula requires two variables. Walmarts inventory turnover for the year equaled.

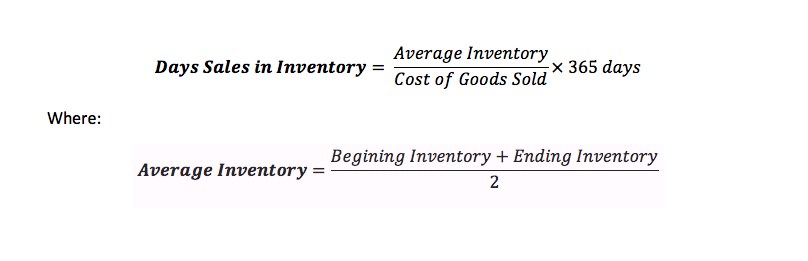

Average inventory Beginning inventory Ending inventory 2. According to this formula the company has more than 3 months of inventory which is actually much higher than their target which was 2 months. This in theory means that if production or supplies stopped then the business would run out of inventory after 41 days.

It is an analytical tool used to gauge the operational efficiency of a business. In this formula the ending inventory is the amount of inventory a company has in stock at the end of the year. The ratio is calculated by dividing the ending accounts receivable by the total credit sales for the period and multiplying it by the number of days in the period.

Number of days sales in inventory days 8. For example if a companys accounts receivable turnover ratio for the past year was 10 the days sales in accounts receivable was 36 days 360 days divided. Most often this ratio is calculated at year-end and multiplied by 365 days.

Days sales in inventory DSI refers to a financial ratio showing the number of days a company takes to turn over all its inventory. 1 875 x. By employing the alternative formula we can confirm that the result of this calculation is correct.

The number of days in the year use 360 or 365 divided by the accounts receivable turnover ratio during a past year. Ratio of liabilities to stockholders equity 10. This number tells you the value of inventory still for sale.

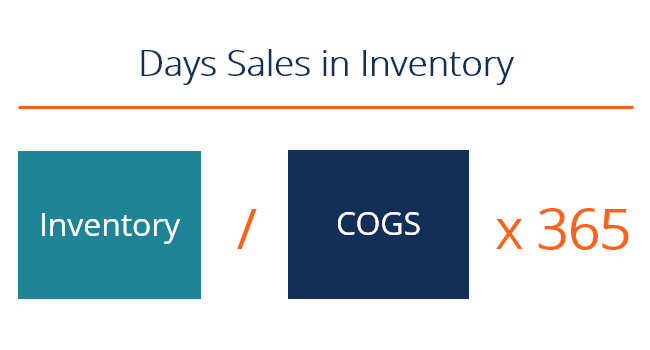

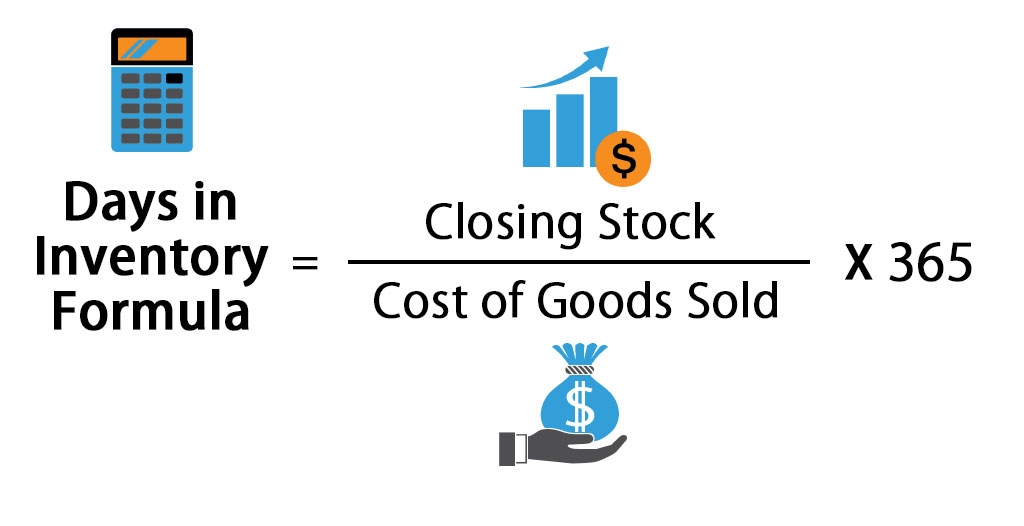

Best applications of the Days Sales in Inventory ratio Lets dive in to what stock shorting specialist John Del Vecchio CFA called the second most important factor for earnings quality analysisthe number 1 being Revenue Recognition with another great ratio for evaluating that called DSO or Days Sales Outstanding. DSI ending inventorycost of goods sold x 365. Its days inventory equals.

We cannot make any judgement regarding inventory turnover days unless we have a benchmark. 3853 billion 443 billion 438 billion2 875. It includes material cost.

Net sales and average inventory. In other words this ratio is a measure of average time in days taken by a company to convert its inventory into sales. Cost of Sales is also known as Costs of Goods Sold Cost of Goods Sold COGS Cost of Goods Sold COGS measures the direct cost incurred in the production of any goods or services.

Inventory turnover ratio 1000000 250000 4. The calculation of the days sales in inventory is. To illustrate the days sales in inventory lets assume that in the previous year a company had an inventory turnover ratio of 9.

The days sales in inventory ratio also known as days stock outstanding or days in stock measures the amount of times it is going to take a business to market all its stock. To calculate days sales in inventory divide the average inventory for the year by the cost of goods sold for the same period and then multiply by 365. Company B 123800 365 5611 days.

How to calculate days sales in inventory.

Days Sales Outstanding Dso Formula And Excel Calculator

Days Sales In Inventory Dsi Overview How To Calculate Importance

Inventory Days Formula How To Calculate Days Inventory Outstanding

Days Inventory Outstanding Dio Formula And Excel Calculator

Days Sales In Inventory Ratio Analysis Formula Example

Inventory Days Formula Meaning Example And Interpretation

Days Sales Of Inventory Dsi Definition Online Accounting

Days Sales In Inventory Ratio Analysis Formula Example

Days Sales In Inventory Definition Formula Calculated Example Analysis

Ineventory Turnover And Days Sales In Inventory Ratios Youtube

Formula To Calculate Inventory Turns Inventory Turnover Rate

Examine The Efficiency Of Inventory Management Using Financial Ratios Principles Of Accounting Volume 1 Financial Accounting

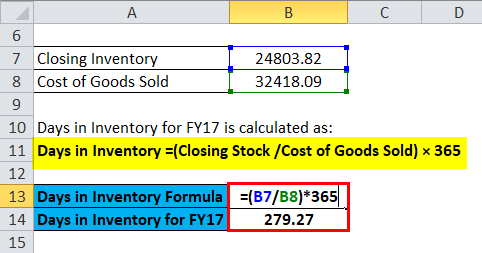

Days In Inventory Formula Calculator Excel Template

Inventory Turnover Ratio Days Sales In Inventory The Two Restaurant Inventory Metrics That Will Help You Squash Food Cost Maximize Profits Apicbase

Examine The Efficiency Of Inventory Management Using Financial Ratios Principles Of Accounting Volume 1 Financial Accounting

Inventory Days Formula Meaning Example And Interpretation

Inventory Days Double Entry Bookkeeping

Days In Inventory Formula Calculator Excel Template

Days Sales Outstanding Formula Meaning Example And Interpretation